The following is a discussion I had on

Japan Forum. Got a debate going on the outlook for the AUD against the Yen.

[QUOTE=tanmedia]If NZ and Australia have a debt crisis, there will be pressure to cut interest rates. The Reserve Banks of both countries are between a rock and a hard place at the moment.

Rising energy costs yet some of the highest debt in the developed world.[/QUOTE]

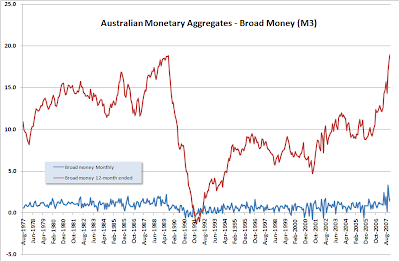

No question there will be a debt crisis but you need to consider 2 things: (I) Australia, and particularly NZ have run much more disciplined monetary policies than the US, so rates never sank to the level of USA, and Australia was far more prosperous. There were 'no doc' loans in Aust, but not to the same level of abuse. (II) The drought appears to have ended, so thats another $6bil of export revenues for next year at a time of rising prices.

[QUOTE=tanmedia] "The Aussie is hostage to competing forces rigth now. On one hand, the endless rise of world commodities prices and the great fall of the US Dollar are good reasons to back the Australian currency. Indeed, Australian exporters can take full advantage of rising gold, metals and energy prices." [/QUOTE]

Well most of those commodity price rises are due to falling USD of late so mixed impact. Precious metals are rising in real terms, base metals are falling. Bulk commodities like coal and iron ore are doing very well. But AUD is rising also because of agric export outlook and higher interest rates whilst US cutting its rates. So I agree with you there.

[QUOTE=tanmedia] "On the other hand however, there is a new event on the FX markets which is bearish for the Aussie: the liquidation of carry trades. Those long-term positions were based on the different interest rates on government bonds in different countries (a basic carry trade being to buy the high yield currency and sell the low yield one). [/QUOTE]

Eh, I thought we just agreed the outlook for AUD was good. I see it breaking $1 parity no question. But maybe you are talking in terms of USD.

[QUOTE=tanmedia]"The dominant carry trade of the last few years was a strong bearish force for the Japanese Yen. It was cheap for global spculators to borrow the yen because of ultra-low interest rates in Japan for years. Since last November roughly, investors become more and more risk averse, fearing a global slowdown and the unknowns of the credit crisis. [/QUOTE]

I think the crux of this argument is whether relative yields are important or absolute yields, and I would suggest relative yields, plus monetary policy. Aust is showing a tighter policy than Japan, so all things being equal, I think we are looking at Y90 being support for the $A. I think the carry trade is not one trade, but some with a long, others with a short term perspective. What forex traders also fail to see is the bent up demand for commodities, ie. The 100 ships waiting off newcastle port, the planned mines which cant get mining equipment. That is keeping metal prices along with strikes.

[QUOTE=tanmedia]"So what have they done? Yen carry traders are getting out of long-term winning positions to lock in profits. They're also making a big change in their asset allocation, which should favour commodities. That's why the Yen is currently in a massive up trend. It's rallied against all the high yield currencies, including the Aussie."[/QUOTE]

Looking at the AUD-JPY, I can see a great looking trade from Y90 to Y100. I think it would be imprudent to expect more. I think you'll find your market comments are old news and pundits are about to jump back into AUD, whilst some will just continue to hold it. The higher agricultural export volumes & prices will take time to come. Terms of trade should improve as well. Can you say the same about Japan with oil prices at $105-115/bbl. Australia producers about 30% of its oil, but add in NW Shelf gasm and it has a net fuel balance.

-----------------------------------------

Andrew Sheldon

www.sheldonthinks.com

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-aud-small.gif)