Its worth at this point pondering the history of the USD. People talk about currencies as if they are a measure of value, but in fact thats not really the case. There are 3 things that determine the relative value of currencies:1. The relative value of the base currency its paired with

2. The sustainable value of the currency for trade and investment

3. The short term speculative value of a currency in terms of its yield

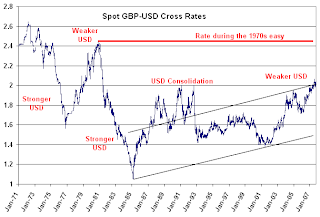

Any class of asset that offers liquidity like the forex market can be traded successfully. So looking at the USD against the British Pound Sterling (GBP) we can see that the USD was strong in the early 1970s on the back of strong economic growth, but as inflationary pressures arose in the late 1970s it fell off considerably. In the early 1980s we have another long rally in the USD as the Fed chairman Paul Voelker aggressively raised interest rates to eradicate inflation. Thereafter there was a period of consolidation which corresponded to pretty goof economic growth in the 1990s. Its noteworthy that the USD was stronger during the brief 2000-1 US recession, but the USD has been weak in the US ever since despite strong US economic growth. This occurred because the Fed reduced interest rates to a record 1%.

There was a brief period of USD strength in 2005-6 as the Fed responded to inflation fears. But from Sept'07 the USD has weakened as the Fed focus has shifted to the weak economy. I frankly am not so confident that the Fed will engage in another period of lower interest rates. I think the market doesn't understand Ben Bernacke's intent. The intent of the Fed will always be to give confidence to the market, and it does that by saying that it will 'drop money from helicopters' to stave off recession or depression. I think the only time a government could do that is during depression or war time. For this reason I think Bernacke will step in and raise interest rates as soon as there are signs that inflation is growing. Since we can't have much faith in the CPI as a measure of inflation, we need to look at other tools, eg. Your shopping basket cost, growth in wages. These are the more reliable trustworthy tools for monitoring inflation because they are price-taker markets.

The problem is that higher interest rates will not eradicate inflation. Inflation is the markets way of correcting an imbalance between the amount of money in the economy and the sustainable level of output. If you expand an economy at such a rate and use debt to finance even faster rates, you can only preserve low inflation as long as speculative asset bubbles are inflating. This process takes pressure off staple prices (because the price increases is borne by asset inflation) and delays wage demands since wage earners are benefiting from stronger property prices and regular work for the family.

Once asset prices fall, there needs to be a corresponding rise in prices to offset the imbalance, as wage earners are now looking for higher wages to restore their purchasing power as prices rise. Inflation keeps rising not because inflation has not been eradicated but because there is still excess money supply in the economy.

I believe in the short run we are looking at a weaker US and global equity markets as Bernacke lowers rates to resuscitate them. I believe he will ultimately be forced to move hard on interest rates as inflationary expectations rise, forcing demand to soften. At that point I think the environment will become a non-issue.

- Andrew Sheldon

www.sheldonthinks.com

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-jpy-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-euro-small.gif)

![[Most Recent Exchange Rate from www.kitco.com]](http://www.weblinks247.com/exrate/24hr-aud-small.gif)